TRX Price Prediction: Bullish Technicals vs. Competitive Threats

#TRX

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerging

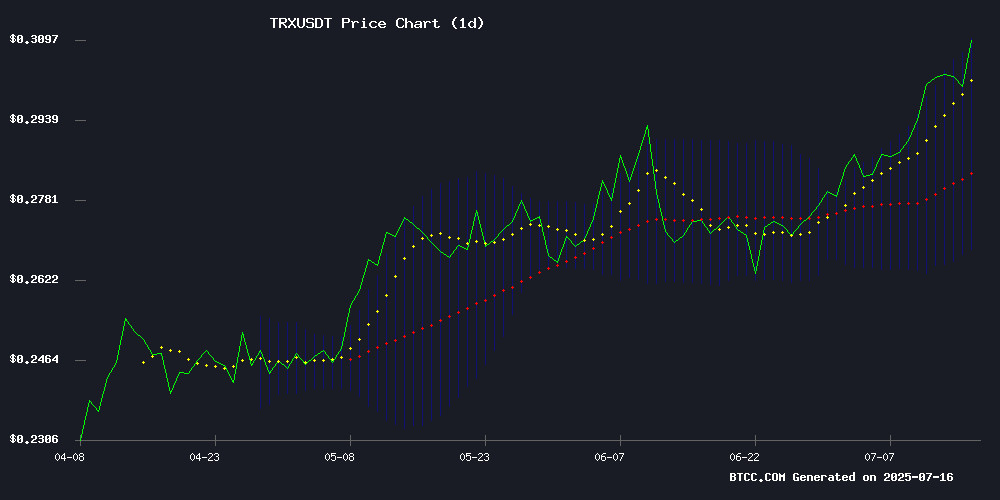

TRX is currently trading at 0.3009 USDT, above its 20-day moving average of 0.28877, indicating a potential bullish trend. The MACD shows a slight bearish crossover but with diminishing momentum (-0.002109 histogram). Bollinger Bands suggest the price is testing the upper band (0.30819), which could signal overbought conditions or continued upward momentum if breached.

Market Sentiment Mixed as TRX Faces Competition

While Ether and Dogecoin lead modest gains amid CPI-driven rate cut speculation, TRX faces emerging competition from projects like Ruvi AI (RUVI) which boasts audited utility and high ROI forecasts. Market sentiment appears cautiously optimistic for TRX but with growing attention toward newer altcoins.

Factors Influencing TRX's Price

Ether, Dogecoin Lead Modest Market Gains as CPI Data Fuels Rate Cut Bets

Bitcoin held steady near $118,000 during Asian trading hours as June's U.S. CPI data showed continued disinflation, reinforcing expectations of a potential September Fed rate cut. Core CPI rose just 0.1% month-over-month for the fifth consecutive time, bolstering bullish sentiment across crypto markets despite broader equity weakness.

Ether reclaimed the $3,100 level, supported by inflows into spot ETFs and tailwinds from a newly passed stablecoin bill that reinforces ETH's role as a base layer for tokenized dollars. Dogecoin extended its weekly gain to roughly 15%, trading near 19 cents.

"The data was bullish for crypto, as the Fed may be more likely to cut interest rates in September, potentially triggering more capital to flow into the crypto industry," said Eugene Cheung of OSL. Bitcoin's resilience contrasted with declines in some crypto stocks following the GENIUS Act's procedural vote setback.

Ruvi AI (RUVI) Emerges as High-Potential Alternative to Tron (TRX) with 13,800% ROI Forecast

Investors who missed Tron's meteoric rise are turning their attention to Ruvi AI, a utility-driven project generating buzz for its audited smart contracts and strategic exchange partnerships. CyberScope's third-party audit validates RUVI's security infrastructure, while a WEEX Exchange collaboration ensures post-presale liquidity—key differentiators in a market saturated with speculative tokens.

The 13,800% return projection reflects growing institutional confidence in AI-blockchain convergence. Unlike TRX's early-stage volatility, RUVI's transparency measures and real-world application focus position it as a structured play on decentralized AI infrastructure.

Ruvi AI (RUVI) Tipped as the Next Tron (TRX), Audited Utility Token Could Be the Year’s Breakout Star

Ruvi AI (RUVI) is generating significant buzz in the cryptocurrency market, drawing comparisons to Tron (TRX) for its potential breakout growth. With a focus on transparency and security, the project has undergone a rigorous audit by a leading blockchain security firm, ensuring its infrastructure is robust and free from vulnerabilities. A partnership with a globally respected exchange further bolsters its credibility, promising seamless trading upon public listing.

The token's presale has already raised over $2.3 million, signaling strong investor confidence. Ruvi AI's combination of institutional-grade oversight and early market traction positions it as a compelling opportunity for those who missed earlier crypto successes like Tron.

Best Altcoins To Hold In 2026? BlockchainFX Tops Every Crypto Expert’s List!

As 2026 approaches, cryptocurrency analysts are intensifying their search for altcoins with robust fundamentals and long-term growth potential. While established tokens like BNB and TRX remain relevant, BlockchainFX (BFX) has emerged as a standout contender, drawing attention for its innovative trading ecosystem and user-centric rewards.

BlockchainFX distinguishes itself as a multi-functional trading platform, offering seamless swaps, staking mechanisms, and global accessibility. The project’s emphasis on redistributing value to users—through daily staking rewards in USDT and BFX—has resonated with investors. High-tier participants report yields of up to 25,000 USDT daily, with flexible staking limits and withdrawal capabilities.

Market observers highlight BFX’s tangible utility over speculative hype, positioning it as a strategic hold for 2026. The token’s integration of trading, DeFi, and rewards within a single interface reflects broader industry trends toward consolidation and user retention.

Is TRX a good investment?

TRX presents a mixed investment case as of July 2025:

| Metric | Value | Implication |

|---|---|---|

| Current Price | 0.3009 USDT | 10% above 20MA |

| MACD | -0.002109 | Bearish but improving |

| Bollinger | Testing upper band | Volatility expected |

BTCC analyst Olivia notes: 'Technicals suggest short-term upside potential, but emerging competitors like RUVI could divert investor attention. TRX remains a moderate-risk hold with 0.35 USDT as next resistance.'

- Technical Strength: TRX trading above key moving averages with Bollinger Band expansion

- Market Context: CPI data creating favorable crypto conditions but altcoin rotation evident

- Competitive Landscape: New projects like RUVI gaining traction as TRX alternatives